What can LTC do to stabilize the price of LTC to ensure miners dont leave the network and continue to provide enough hash rate to seamlessly process transactions??

If you are a miner, my humble suggestion is to sell all of the Litecoin you hold at the moment it is mined. Litecoin is prone to hard crashes, so unless you plan to live with it for years, sell it right away.

It’s hard to stabilize the price, unless you have a huge amount of the free supply at your disposal. The price is created from the market activity (buying and selling), so to control the price implies controlling the free supply and the market participants.

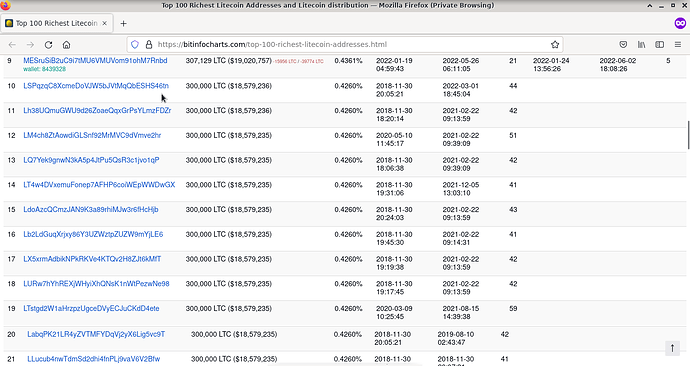

I have observed that there are a few Litecoin addresses with a huge amount of unspent Litecoin, all of them have a suspiciously precise 300,000 litecoin.

This is so odd, as if there is someone out there flashing their wealth for everyone to see. Why is that? I believe there is a group of whales that intend to stabilize the price of Litecoin and they are trying to achieve this aim by reducing the free supply (the Litecoin that is being traded on exchanges). When there is little volume, the price is easily controllable.

I have been observing the trading activity in the past year, and there are special minutes where one can see this group of whales in action. As an example, there was a specific day where the price of Litecoin was reaching the unbelievable mark of 350 USD! What a high price for something that is inherently worthless! In this day, I have seen the first minute where a massive sell order pushing the price down to exactly 335 USD. I interpreted that strange event as “the whales are hinting that they reject Litecoin above 335 USD”, so the other participants of the Litecoin market should acknowledge their powerlessness when faced with the whales and abide by that. Just like stock market traders know “Don’t fight the FED”, Litecoin traders should know “don’t fight the whales”. However, the market ignored that massive dump and, about six hours later, the price was once again quite above the 335 USD mark (360 USD, 365 USD if I remember correctly) and, again the group of whales dropped a massive sell order reducing the price to exactly 335 USD.

I was watching the trading activity of Litecoin before the bull market. These massive sell orders that happen in a single minute have happened every time Litecoin rose in price, and I began to hypothesize that’s the way the whales (which have a role similar to the chairman of the FED) send briefing to the market regarding where they want the price of Litecoin to be.

I could be wrong though. This is just hypothesis.

one thing we can do is deleverage LTC on exchanges

How can we do that, though? Leverage is simply borrowing money. If an exchange owns Litecoins, what prevents the said exchange from lending their Litecoins for other people to sell?

I actually think that would be detrimental to cryptocurrencies, though. Lending and borrowing is one of the few legit use cases that cryptocurrencies have, and borrowers have two beneficial activities to the environment:

- Their act of selling borrowed cryptocurrency depresses the price, which makes cryptocurrencies more affordable to everyone.

- In order to regain their collateral, they have to pay back their loan with interest, thus they will purchase cryptocurrency in the future, providing liquidity and activity to the market.

I know that exchanges can mint fake Litecoins with fractional reserve, but that’s not a problem for the overall environment (it’s a problem for the exchange, that might face a bank run). If what matters to people is the fiat price of Litecoin, either a legit Litecoin or a fake Litecoin will do, because once one cashes out by selling Litecoin for fiat, it does not matter if what is being given back to the exchange is a legit or fake one. If it’s a legit one, the reserves of the exchange are increased. If it’s a fake one, it’s burned and removed from the fake supply. Either way, the seller gets the fiat and the exchange gets the Litecoin, legit or fake, completing a mutually beneficial exchange.

Fractional-reserve exchanges are simply short-sellers themselves, borrowing the customers funds with a 0% interest rate to sell it in the market . If they are using the money obtained from selling fake Litecoin to build things, that’s better than letting the money staying idle in their secret seed phases.

… is there a block button on here? lmfao

“sell all of your litecoin as it comes”… brilliant advice

Yeah apparently HODL philosophy is difficult for some to grasp. Processing transactions to use litecoin of purchases will suffer if the Hash rate is drastically reduced due to miniers loosing money.

Litecoin was below 40 USD for about two years, and yet the hash rate was just fine in that period. This price level might not be profitable for some miners (thus they naturally leave the hash rate), but it’s profitable for other ones that will continue to work and secure the network.

I agree many will stay. The problem with comparisons with 2 years ago is the difference in economic inflation on a global scale and energy costs were significantly reduced.

It is good advice. I mine LTC everyday and once every 10 days I convert what I have mined to BTC. BTC has outperformed LTC by multiples since I started mining 5 years ago. If I had held all the LTC I mined my net worth would be much less.

How does cashing out LTC for BTC stabilize the price of LTC? My question is how to stabilize the price so people dont have to make that choice. Stability v profitability.

it doesn’t help stabilize the price, these users don’t believe in the technology of Litecoin! they only care about PROFITS!!! which has done nothing but destroy the price of LTC! i can tell you that most LTC holders do not feel this way…

I for one will not advocate for the selling of LTC, because it is the best of the best and the technology will change the world. Do not be dismayed by the trolling bears who do not believe in technology.

In order to deleverage LTC on exchanges (meaning getting rid of x5, x10, ect.) we would petition the exchanges to so, also if they want to use LTC for leverage on exchanges they must buy the LTC first and use their own supply, and not the supply of the token as a whole.

i hate the fact YOU are a ltc miner… if that’s the case i’ll setup my own LTC mining camp and show you how to get things done.

-

Kucoin offers borrowing of USDT for your collateral LTC so you don’t have to sell it in order to make your profits… Just like the bitcoin miners do.

-

selling LTC at this price hurts the normal investors just getting into the space meaning you have no morals or understanding of how your actions directly effect investors or even institutions getting in…This only assuming you give a damn.

-

Selling LTC for BTC… ok cool, and that helps LTC price how?? it doesn’t.

i would recommend you take your hashrate elsewhere like bitcoin since you prefer to buy that anyways.

if you are a miner your responsibilities to the network are on another level!

You cannot simply just act like a child thinking only of price. i know i am wasting time typing this, But i’m not aiming to convince you. THIS is for all those who will read these words and be encouraged that there still is a KNIGHT for Litecoin!

That’s dangerous and inefficient. Exchanges usually lend for 65% LTV (loan-to-value), so one would only get that from the full fiat value they’d get from selling the cryptocurrency. Also, if one is not careful, one might get margin called and liquidated. It’s possible to adjust the risk of a margin call by reducing the LTV, but then one would get even less fiat for their crypto.

I don’t trust KuCoin, by the way. I have removed all of my assets from there and, after the fact, they have unilaterally locked me out of my account. I did something they disliked (cash out), so they have punished me accordingly. Fortunately decentralized exchanges are emerging and soon we won’t need to rely on centralized exchanges that have whims and hidden agendas.

If nobody sold LTC, how would you get some LTC? Unless you’re a miner yourself, you probably got any LTC that you might hold from buying it from someone that sold it to you.

I sell my LTC for BTC because since I got into mining LTC is up 6X and bitcoin is up 35X. My job as a miner is to supply hashpower. I do that and get paid for my efforts. It is my business how I spend my earnings. Nobody in this world has to explain to anyone how they spend their paycheck. My savings are in crypto. I hold mostly bitcoin and ethereum because they appreciate. Litecoin does not perform well so I don’t hold that much. I mine whatever supplies the biggest return. Over the last 5 years most of my mining has been bitcoin. But I have a few dozen L3 machines and now that they do combine mining of LTC and other coins at litecoinpool.org it pays better than mining bitcoin. When it doesn’t I unplug my litecoin machines and plug in my bitcoin machines. There is no need for me to support litecoin by holding it. That would be charity. Litecoin doesn’t need to be stabilized. The free market will determine it’s fair value. Anything else just mimicks fiat currency.

You can deleverage LTC on all the exchanges that YOU own. To ask someone else to do that on an exchange that they own is a pathetic waste of time. They are in business to make money. It is a free market. If you want a stable coin, buy stablecoins.

Wouldn’t it add more stability to day trade the LTC buying the dip and selling the highs increasing profitability and adding stability to LTC, rather than buy BTC adding stability to BTC?

If you make money trading, go ahead. I prefer to HODL long term and adding to positions when BTC drops 50% or more. I don’t day trade because of all the accounting involved. Every trade cost you commissions also. I run a garage full of miners and mine whichever fork of bitcoin pays the best daily rate. Ultimately I try and hold 60% BTC, 30% ETH, the rest is in LTC and 24 other alt coins. I hold about 4 times as many LTC as BTC since there are 4 times as many LTC ultimately when all the block rewards come to an end. It is not my ambition to to pick the next bitcoin, because it is likely going to remain BTC is the top coin. I used to have more confidence in LTC until the founder dumped all of his LTC. It has continuously lost ground against bitcoin over the years, it is currently making new all time lows against BTC as we speak. It is trading at 0.002105 BTC. When I started mining it was trading at 0.0125 BTC so BTC has outperformed LTC by 6X. That is not going to change in my opinion.

How can we anticipate the changes? We just have to do what the situation asks of us and protect our bitcoins.

When and if the Litecoin developers bring the coin’s acceptance and liquidity levels close to those of leading government-issued currencies. This may be accomplished by limiting the number of currencies created and exchanged in the digital crypto realm.

If the price of LTC becomes stable, then not only miners will be interested to mine the coin, but its market capital will also increase by the demand and supply theory.