Yes, and historically the ratio settles at about 30:1. I think it was about 15:1 in the Greco-Roman times. Silver is way underpriced these days.

However, I think the analogy does stack up.

That justifies gold’s store of value, but not its value as a medium of exchange. Silver is good enough for functional money.

That’s stepping into dangerous territory, as the Subjective Theory of Value (Menger’s) underpins cryptocurrency.

Again, that’s great for gold’s ‘store of value’. But if silver coins were allowed to be used as money, then silver would have many advantages, as a medium of exchange. Gold tends to be hoarded, and its really hard to use it for small purchases, like a bag of carrots. Silver is easier to mine and mint, but strikes a great balance, because its scarce too.

I love Safedean Amous’s Bitcoin Standard but I think his arguments against silver are not sound. For example, he claims that the British Empire became supreme thanks to its gold standard, but he puts the cart before the horse. The gold standard became supreme thanks to the British Empire.

As a medium of exchange, yes - just like silver. But, if you want to argue from utilitarian grounds (dangerous territory for crypto), then BTC has the security of all that hashpower. It has the most nodes to threaten a hard fork if a mining company became dominant. For a store of value, I would back BTC.

So in summary the gold/silver analogy holds because…

Gold/BTC is a great store of value and a good medium of exchange.

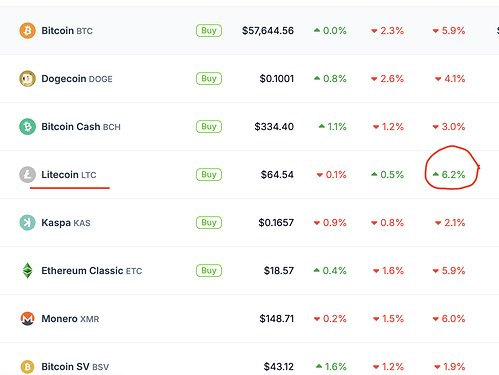

Silver/LTC is a great medium of exchange and a good store of value.

(That is not taking into account the cultural factor, which we really should…)